Payment

The Payment feature in Lumyri provides you with a comprehensive set of tools to manage your transactions and optimize your experience with our services.

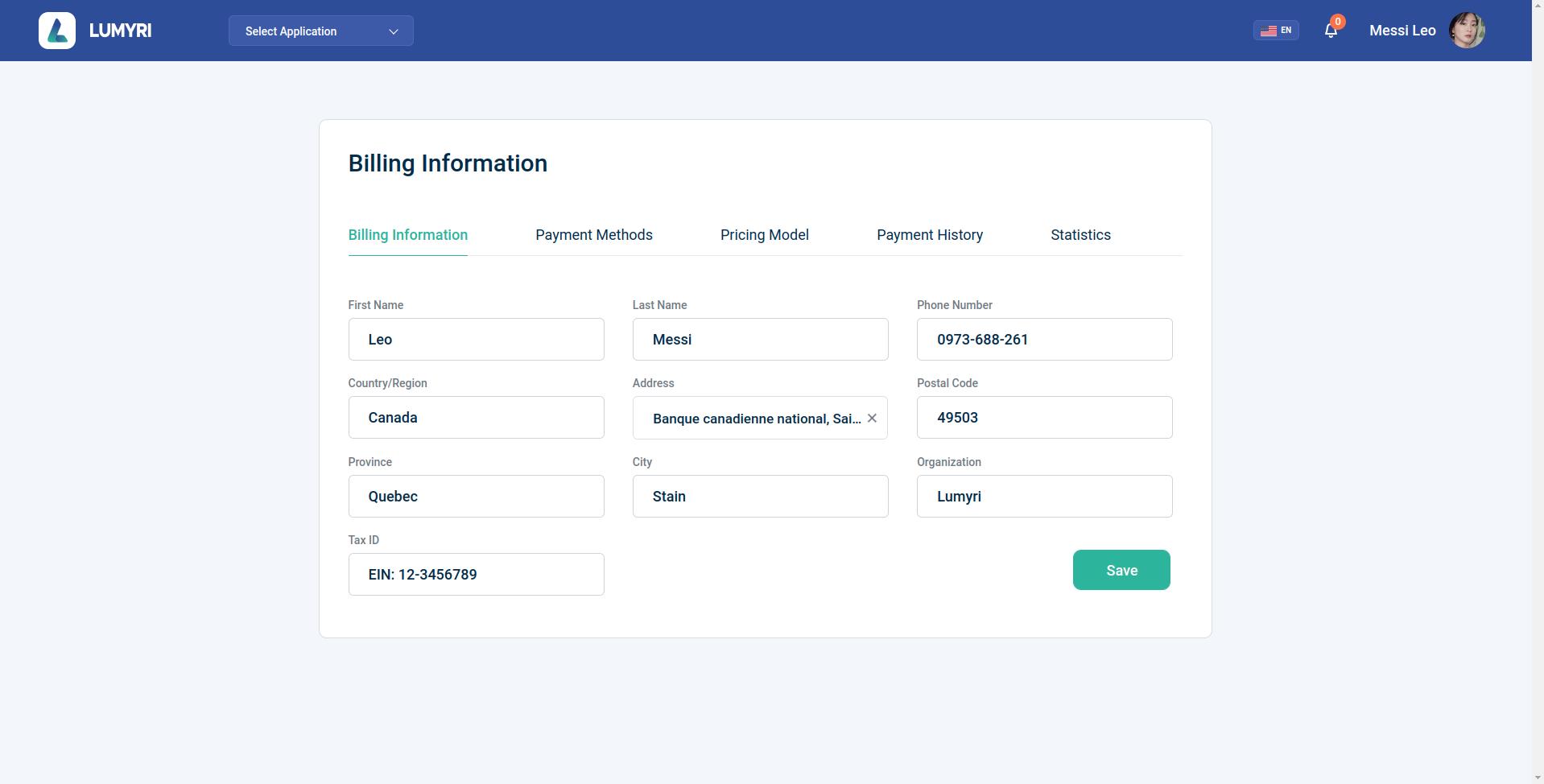

1. Billing Information

To ensure a smooth and efficient billing process, we kindly request you to provide us with your essential billing details. Your billing information is essential for generating accurate invoices and keeping you informed about your account.

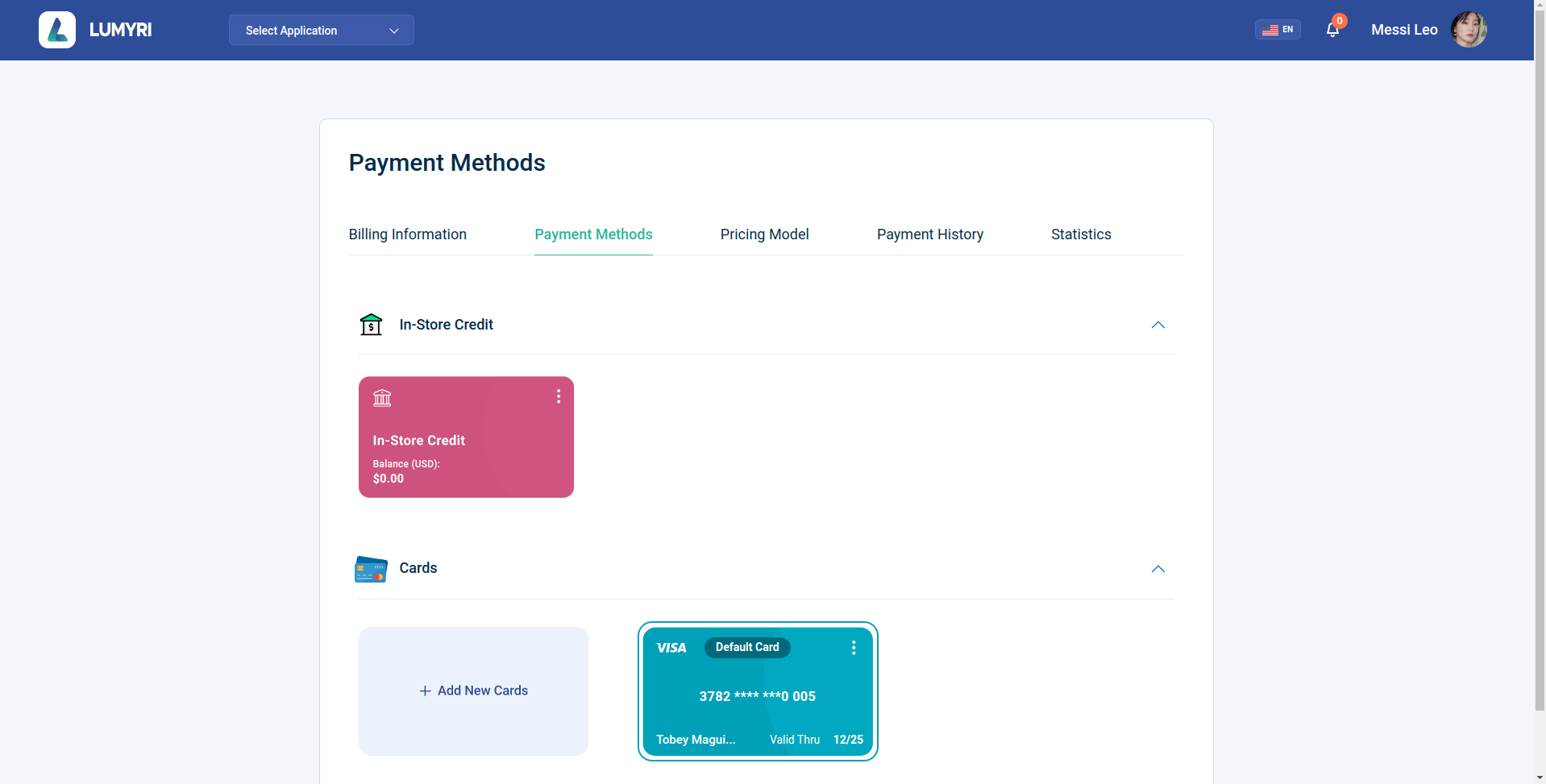

2. Payment Methods

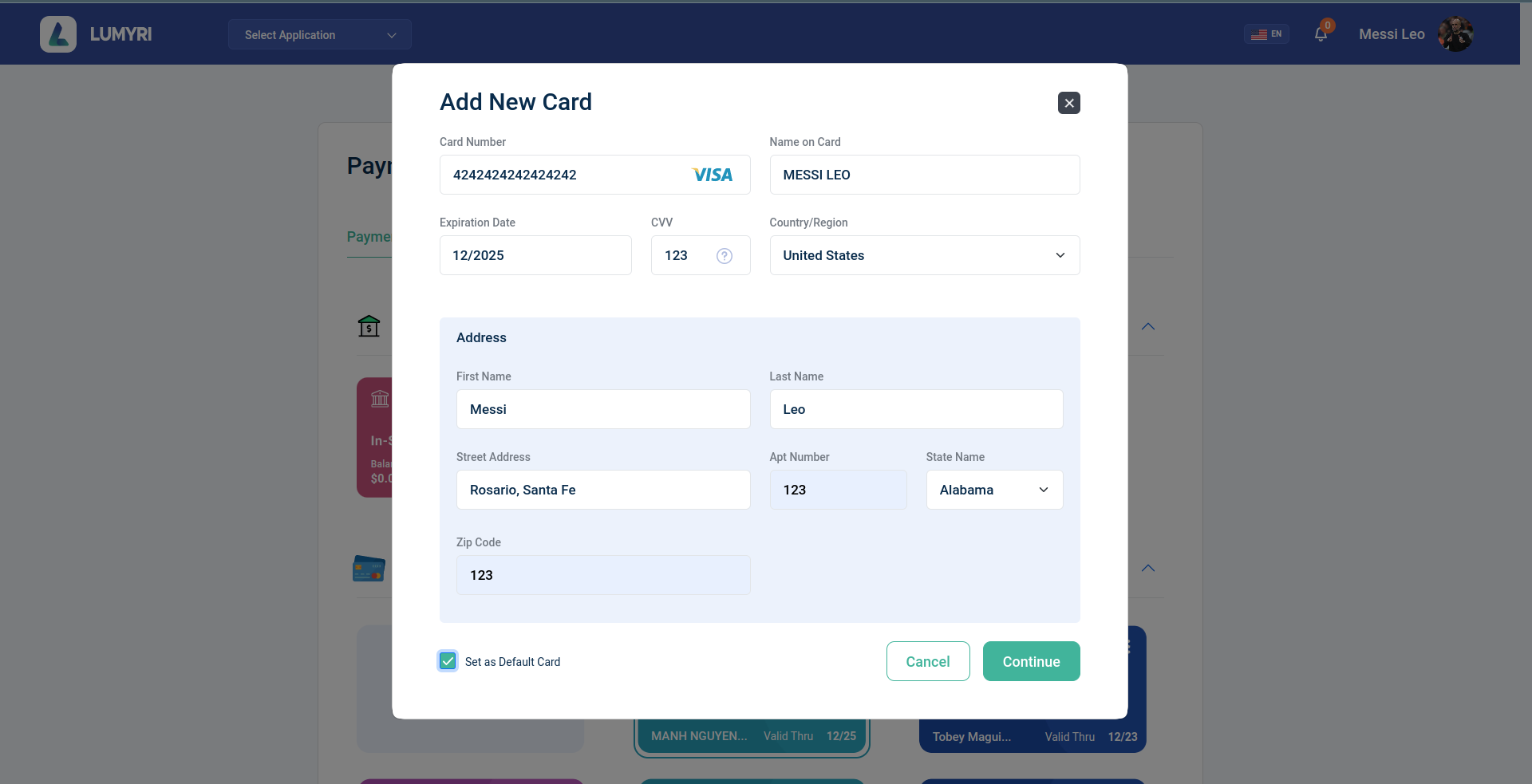

We offer a selection of registered payment options for using Lumyri services. We do not store any payment information on our servers. All payment transactions are securely processed through trusted payment gateways. We prioritize the protection of customer privacy and ensure the safety of their personal information.

We currently support the following payment methods:

- Credit card

- Visa card

- Mastercard card

- American Express card

To use Lumyri services, customers are required to add a payment card for easy monthly bill payments.

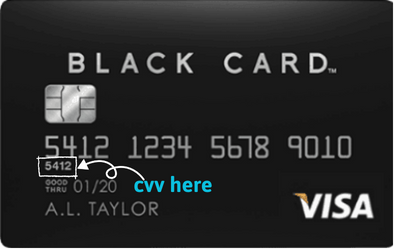

The CVV Number ("Card Verification Value") on your credit card or debit card is a 3 digit number on VISA®, MasterCard® and Discover® branded credit and debit cards.

Providing your CVV number to an online merchant proves that you actually have the physical credit or debit card - and helps to keep you safe while reducing fraud

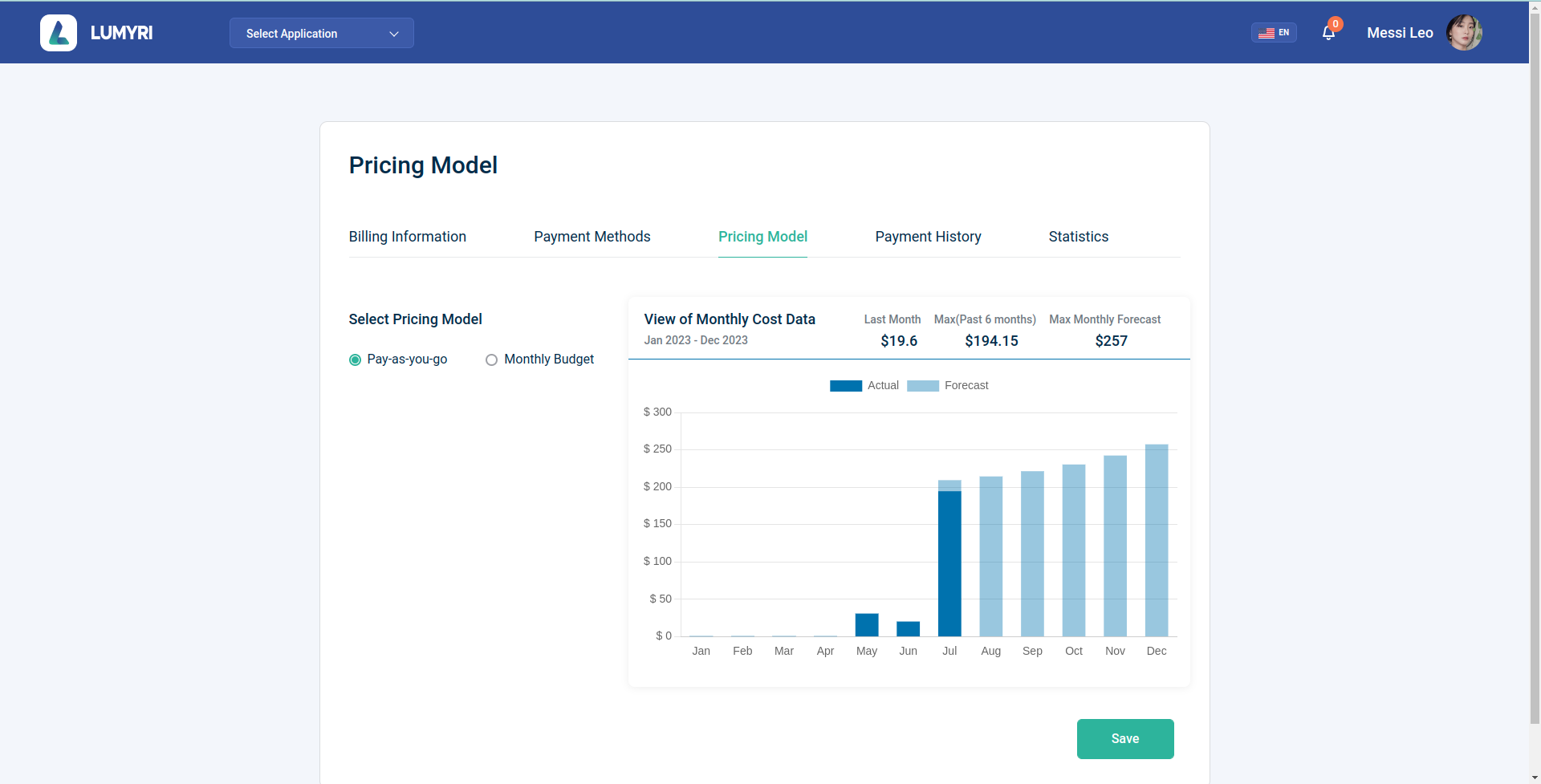

3. Pricing Model

By default, the Budget feature is set to Pay As You Go (PAYG). Under this mode, you will be charged for all services based on actual usage.

We rely on the budget data from the last 6 months up until the current month to predict the expenses for the upcoming months for our customers. This allows us to provide more accurate estimates and helps our customers plan their usage and budget accordingly.

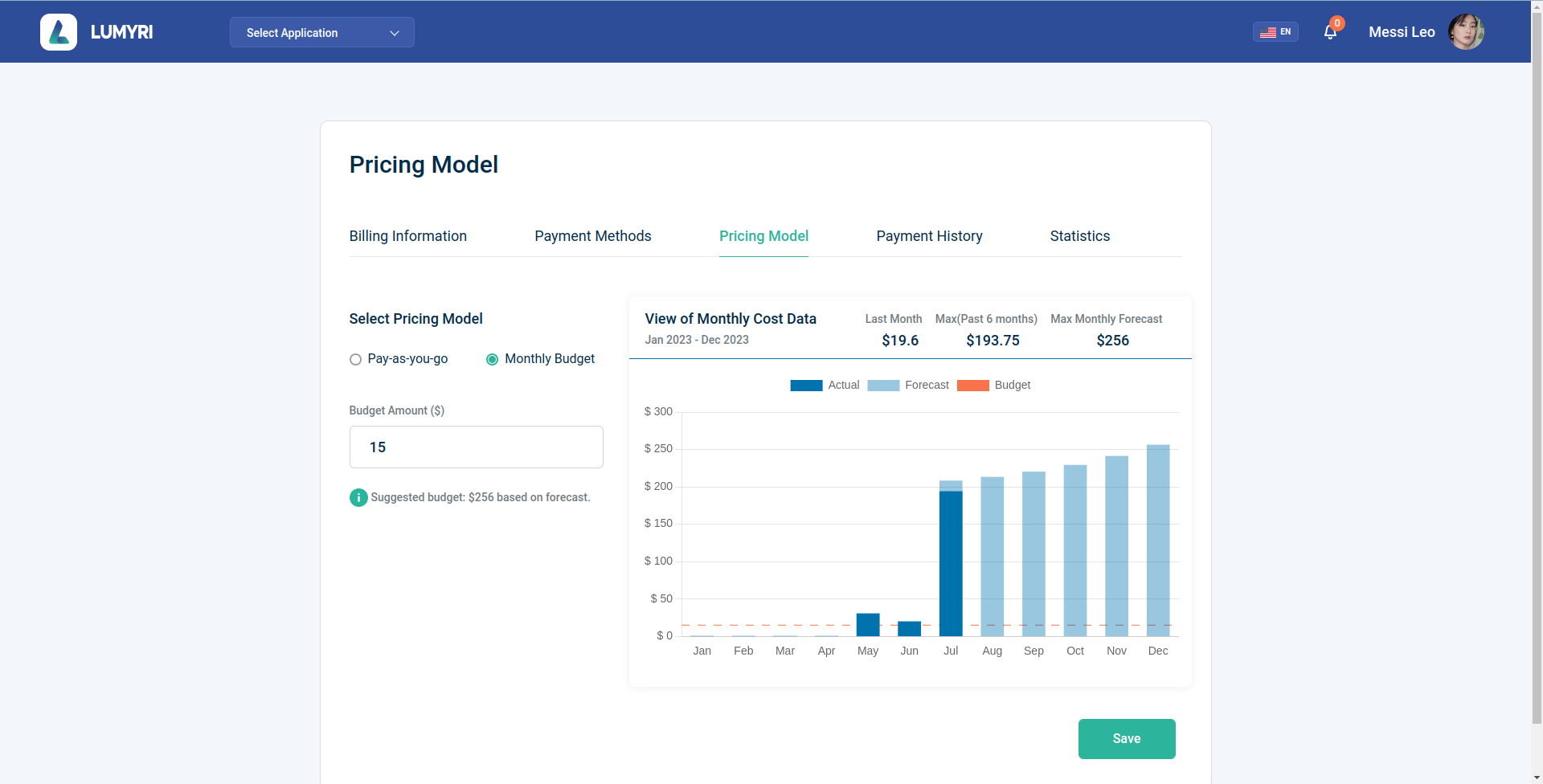

If you prefer a Monthly Budget plan, you can set a specific budget (Amount) for the upcoming month. The system will apply this budget to the following months.

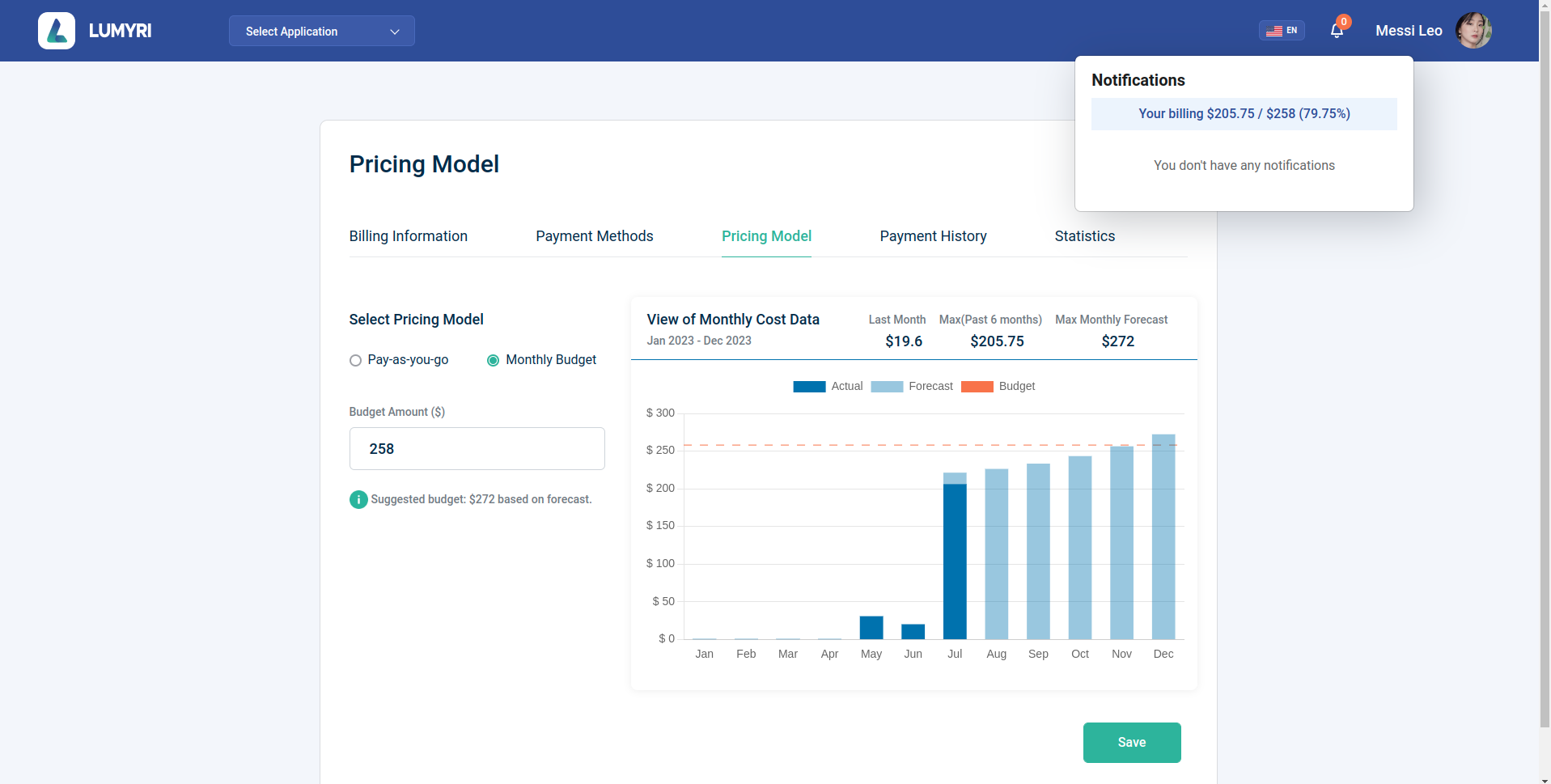

When you use the Monthly Budget plan, your billing information will be displayed as "Your billing $bill/budget".

The Grace Period is a special time frame when you reach your preset budget but the system allows you to continue using the services for an additional 5 minutes. Upon reaching the budget threshold, you will receive an email notification indicating that the budget has been reached.

After the Grace Period expires, all services will be frozen, meaning you will no longer be able to use them.

To unlock the frozen services, you have two options:

- Increase the budget: You can increase the budget for the Monthly Budget plan to continue using the system.

- Choose Pay As You Go (PAYG): Alternatively, you can switch to the PAYG plan, where you will be billed on a usage basis.

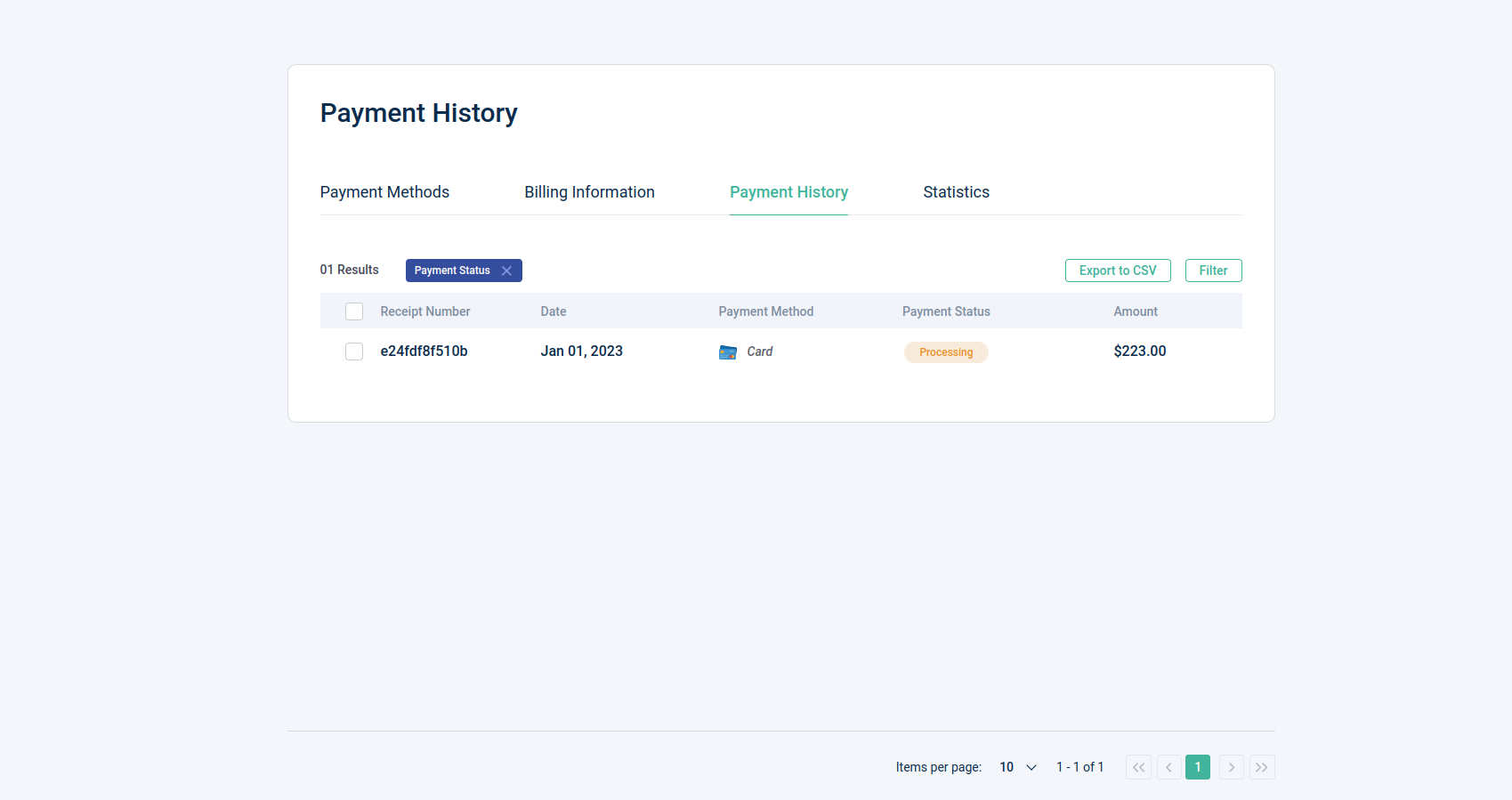

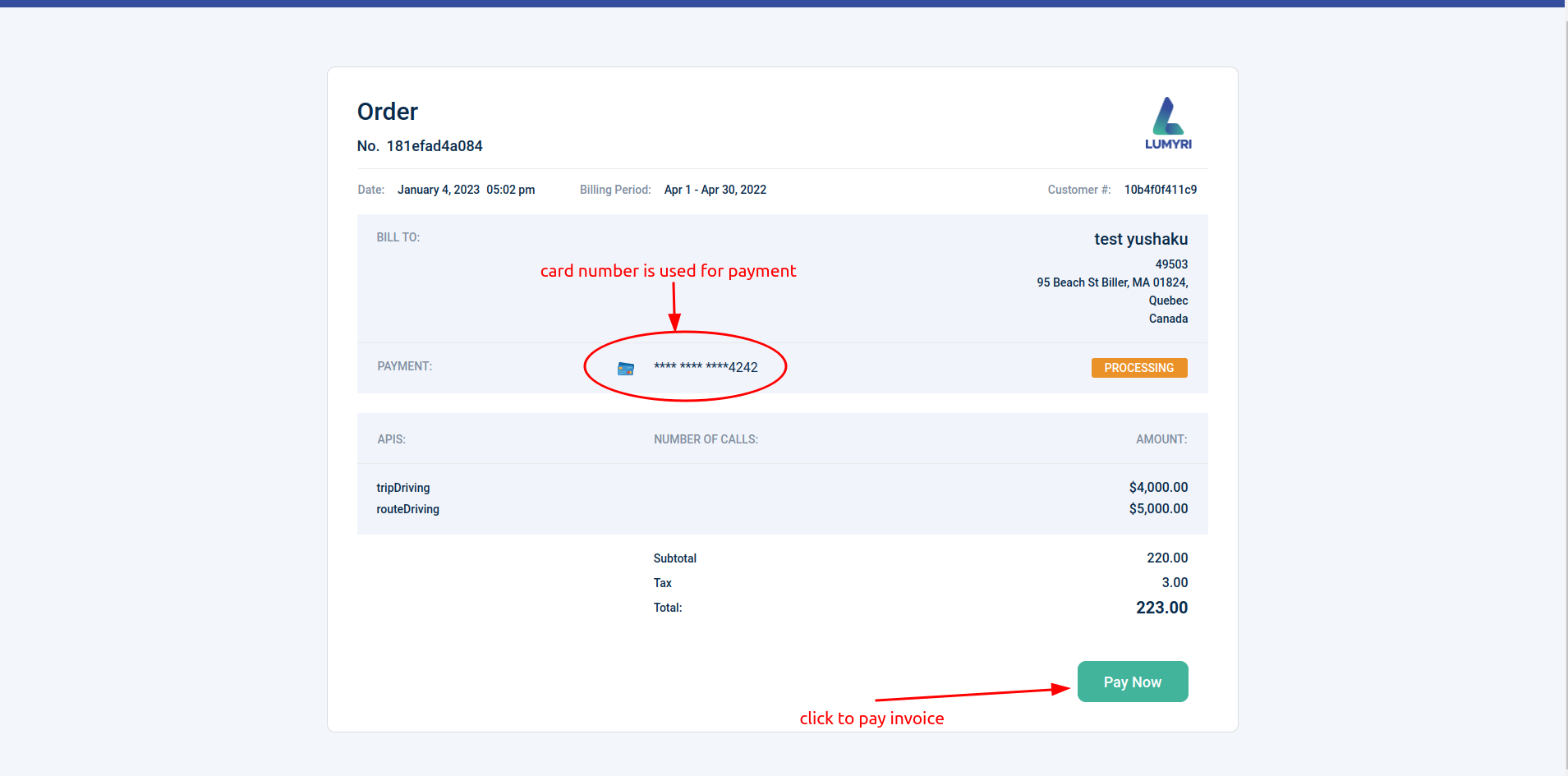

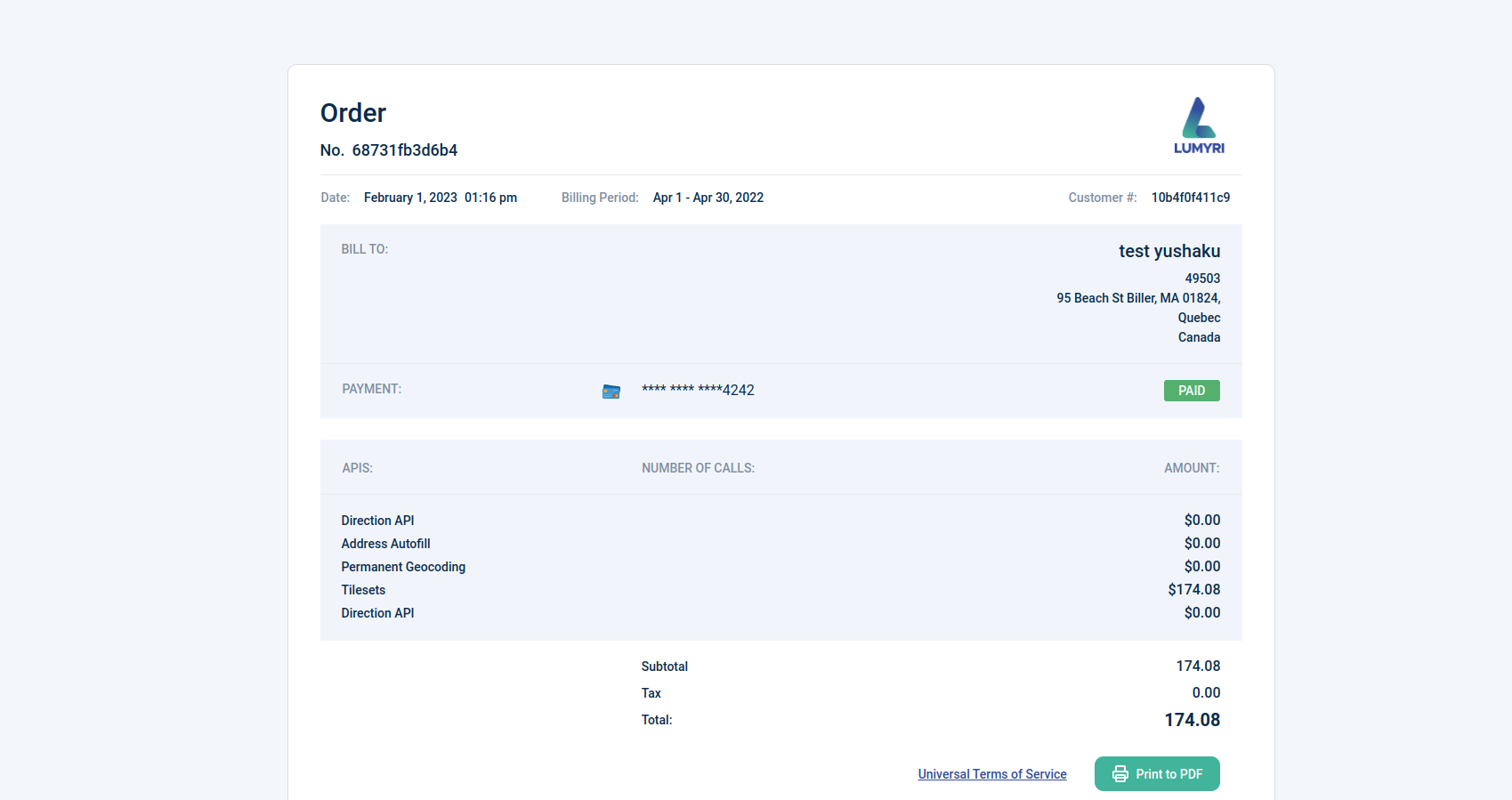

4. Payment History

Your payment history will display all your monthly invoices (Processing, Failed, Success). For invoices that require payment (Processing), you can review the details and proceed to make the payment to continue using our services.

When pay invoice successful

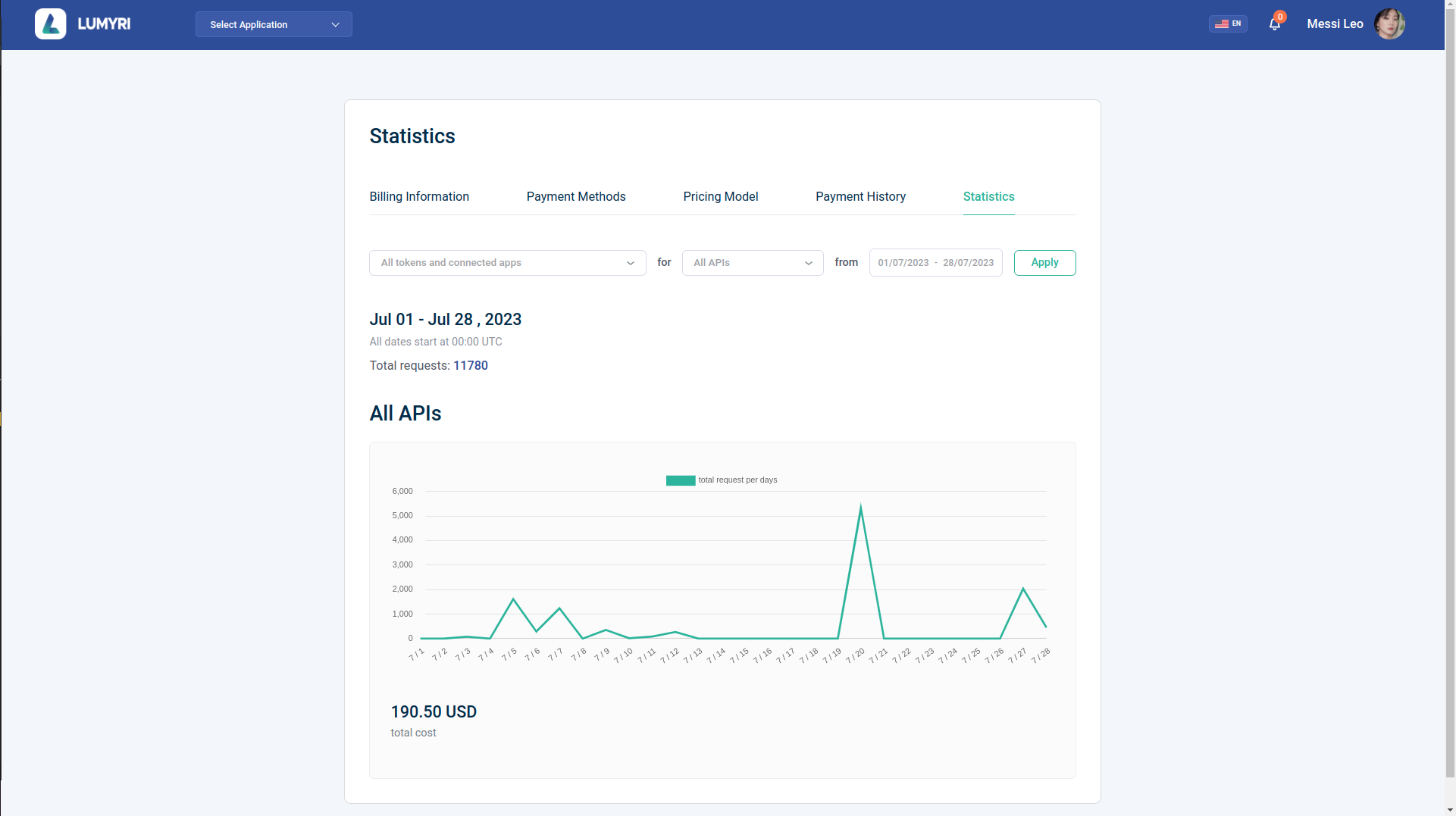

5. Statistics

With Statistics, you can effortlessly access and analyze the usage data of our map services on a daily basis. Gain valuable insights into the number of requests made to our map APIs, and apply filters to view data for specific apps and request quantities within custom time ranges. Make data-driven decisions to optimize your map service usage and enhance your overall experience

Security

We take the security of our users' payment information very seriously. All payment transactions are processed using industry-standard encryption and security protocols to ensure that sensitive information is protected.

We hope that this payment feature will enhance your experience with our app. If you have any questions or feedback, please feel free to contact us at any time.